The recent turmoil in global financial markets has left investors jittery, with the S&P 500 experiencing significant downside pressure. As per the analysis provided in the reference link, the S&P 500 downside target is identified at 4800. This prediction has raised concerns among market participants, as the index has been a key barometer of economic health and investor sentiment.

The S&P 500, comprising the 500 largest publicly traded companies in the U.S., is often considered a bellwether for the broader stock market and the overall economy. A downturn in the index can signal investor pessimism and economic uncertainty, leading to widespread selling and further declines in other equity indices.

Several factors have contributed to the downward pressure on the S&P 500. Rising inflation, supply chain disruptions, geopolitical tensions, and the Federal Reserve’s monetary policy decisions have all played a role in dampening investor confidence. The prospect of higher interest rates and reduced liquidity has added to the selling pressure on stocks, pushing the index towards the downside target of 4800.

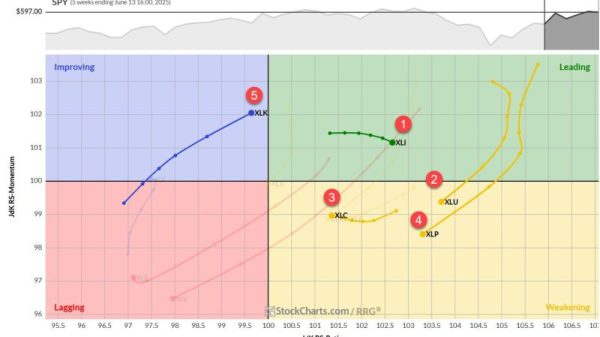

Investors are closely monitoring key levels of support and resistance to gauge the market sentiment and potential price movements. Technical analysis, as highlighted in the reference link, can provide insights into possible future trends and the likelihood of the S&P 500 reaching the downside target. Traders are adjusting their positions and risk management strategies in response to the heightened volatility and uncertainty in the market.

While the downside target of 4800 may seem alarming, it is essential for investors to maintain a long-term perspective and focus on their investment goals. Market corrections are a normal part of the economic cycle and can present buying opportunities for savvy investors. Diversification, risk management, and staying informed about market developments are essential practices to navigate turbulent market conditions and protect one’s investment portfolio.

In conclusion, the S&P 500 downside target of 4800 underscores the current challenges facing global financial markets. Investors need to exercise caution, remain vigilant, and adapt their strategies to the evolving market dynamics. By staying informed, being proactive in risk management, and seeking professional guidance when needed, investors can navigate the stormy seas of market volatility and emerge stronger and more resilient in the long run.