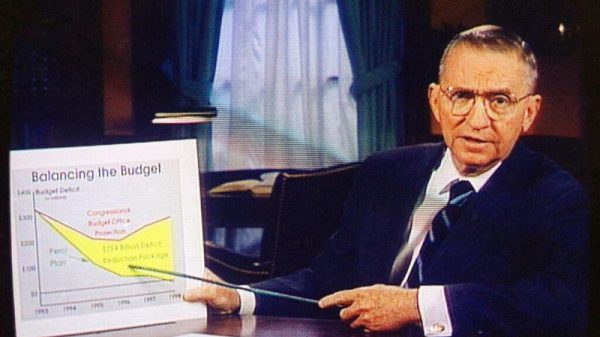

In the latest release of the Federal Reserve meeting minutes, concerns have been raised about the lack of visible progress on inflation and the potential implications for the economy. The discussions during the meeting shed light on the ongoing challenges faced by policymakers in achieving their inflation goals and the strategies being considered to address the situation.

One key point highlighted in the meeting minutes is the recognition that inflationary pressures have remained subdued despite various policy measures implemented by the Federal Reserve. This has led to growing apprehensions about the sustainability of the current economic momentum and the need for additional policy actions to spur inflation. With inflation running below the target level of 2%, there is a consensus within the Federal Reserve that more needs to be done to stimulate price growth.

Another crucial issue discussed in the meeting minutes is the impact of external factors such as trade tensions and global economic uncertainties on the inflation outlook. The Federal Reserve officials acknowledged the potential for these external developments to further dampen inflationary pressures and pose challenges to achieving the desired inflation trajectory. As such, there is a growing realization that the Federal Reserve may need to reassess its policy stance in response to these external headwinds.

The meeting minutes also revealed a lively debate among policymakers regarding the appropriate course of action to address the inflation shortfall. Some officials expressed concerns about the potential risks associated with further monetary easing, including the possibility of fueling asset bubbles and exacerbating financial imbalances. On the other hand, there were voices advocating for a more aggressive policy stance to ensure that inflation reaches the target level within a reasonable timeframe.

In light of these deliberations, the Federal Reserve is considering a range of policy options to address the persistent low inflation environment. These options include further interest rate cuts, changes to the balance sheet normalization process, and enhanced communication strategies to better manage inflation expectations. While no specific decisions were made during the meeting, the minutes indicate a strong commitment on the part of the Federal Reserve to take action if needed to support inflation.

Overall, the latest Federal Reserve meeting minutes underscore the challenges posed by the lack of progress on inflation and the complexities involved in managing the current economic environment. As policymakers navigate these challenges, they will need to carefully weigh the trade-offs associated with different policy actions and monitor developments closely to ensure that inflation remains on track towards the target level. By remaining vigilant and responsive to evolving economic conditions, the Federal Reserve aims to support sustainable growth and price stability in the long run.