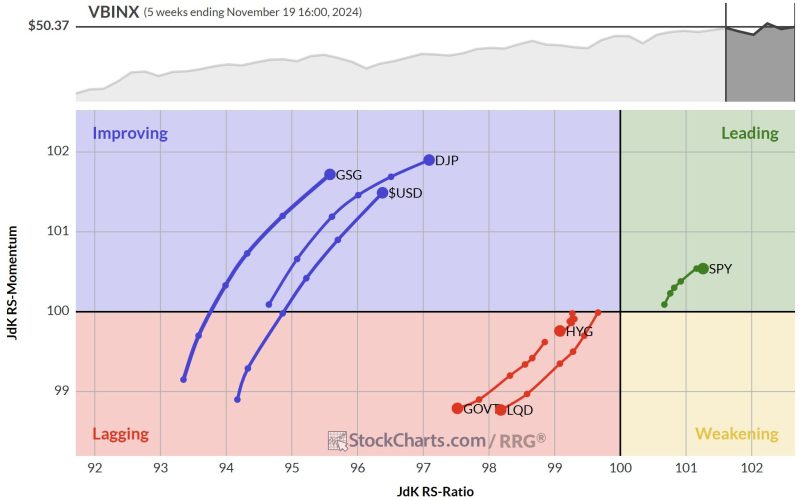

As the global financial markets continue to navigate through uncertainty and volatility, the USD is emerging as a focal point for investors seeking stability and potential opportunities. With various geopolitical tensions and economic concerns impacting currency valuations across the board, the USD is showing signs of a potential rally that could have significant implications.

One of the key drivers behind the USD’s potential rally is the Federal Reserve’s monetary policy stance. The Fed’s recent signals of a more hawkish approach towards tapering its asset purchase program and potentially raising interest rates sooner than expected have bolstered the USD’s appeal among investors. This shift in policy outlook reflects the Fed’s confidence in the US economy’s recovery and its determination to address inflationary pressures.

Furthermore, the USD’s status as the world’s primary reserve currency provides it with a unique advantage during times of uncertainty. Investors tend to flock to the USD as a safe haven asset, especially in times of heightened geopolitical risks or market turbulence. This flight to safety factor could further support the USD’s rally, especially if global uncertainties persist.

In addition to the Fed’s policy outlook and safe haven status, the US economic fundamentals are also playing a crucial role in shaping the USD’s trajectory. The US economy has shown resilience in the face of various challenges, with robust economic data pointing towards a strong recovery momentum. Stronger economic performance, coupled with solid corporate earnings and consumer spending, could further bolster investor confidence in the USD.

Moreover, the USD’s relative strength compared to other major currencies, such as the Euro and the Yen, is also influencing its potential rally. While other central banks remain cautious in their policy approaches, the Fed’s proactive stance is setting the USD apart in terms of yield differentials and attractiveness for investors seeking higher returns.

However, it’s worth noting that the USD’s rally is not without risks and challenges. Any unexpected developments, such as a resurgence in Covid-19 cases, geopolitical tensions escalating, or a sudden shift in market sentiment, could derail the USD’s upward trajectory. The interconnected nature of the global financial markets means that external factors could quickly impact the USD’s rally.

In conclusion, the USD appears to be setting up for a potential rally driven by a combination of factors, including the Federal Reserve’s policy stance, safe haven appeal, strong economic fundamentals, and relative strength compared to other currencies. While the path ahead is not without risks, the USD’s potential rally could present opportunities for investors to navigate through turbulent market conditions and find stability in uncertain times.