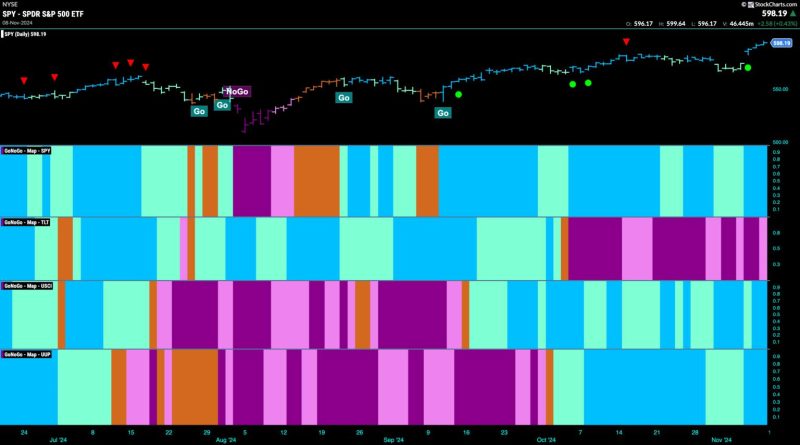

Equity-Go Trend Sees Surge in Strength as Financials Drive Price Higher

The Equity-Go trend has been gaining momentum in recent months, with a surge in strength driven primarily by the financial sector. This trend is a reflection of the growing investor interest in equity markets and the increasing importance of financial stocks in driving market performance.

Financial institutions have been leading the charge in propelling the equity market higher, with strong earnings reports and robust performance bolstering investor confidence. As a result, stock prices in the financial sector have been rallying, contributing significantly to the overall positive sentiment in the equity markets.

One of the key drivers behind the strength of the Equity-Go trend is the low-interest-rate environment. With interest rates at historically low levels, investors are turning to equities in search of higher returns. Financial stocks, in particular, have been attractive to investors seeking capital appreciation and dividend income in a low-yield environment.

Another factor fueling the Equity-Go trend is the improving economic outlook. As the global economy continues to recover from the impact of the COVID-19 pandemic, investor confidence is on the rise. Optimism about economic growth prospects has translated into increased demand for equity investments, driving up stock prices across sectors.

Technology is another industry that has been contributing to the strength of the Equity-Go trend. Tech stocks have been rallying as companies benefit from the accelerated digital transformation and remote work trends brought about by the pandemic. Investors see tech stocks as attractive long-term investments due to their potential for growth and innovation.

In addition to financial and technology sectors, other industries such as healthcare and consumer discretionary have also been performing well, adding further momentum to the Equity-Go trend. As the global economy transitions to a post-pandemic era, investors are increasingly looking for opportunities in sectors that stand to benefit from changing consumer behaviors and market dynamics.

Overall, the Equity-Go trend reflects the prevailing investor sentiment in the equity markets, driven by a combination of factors including strong performance in financial and technology sectors, low-interest rates, and improving economic conditions. As investors continue to allocate capital towards equities, the trend is expected to remain robust, with potential for further gains in the foreseeable future.