Secular Bull Market Continues, but with Major Rotation

Amidst the backdrop of uncertainty and market volatility, the secular bull market in stocks continues to prevail. However, recent market trends indicate a major rotation in investor preferences and sectors. This shift calls for a reevaluation of investment strategies and a keen eye on emerging opportunities.

The foundation of the ongoing secular bull market lies in several key factors, including robust corporate earnings, low interest rates, and accommodative monetary policies. These fundamentals continue to support the upward trajectory of stock prices and maintain investors’ confidence in the market’s long-term growth potential.

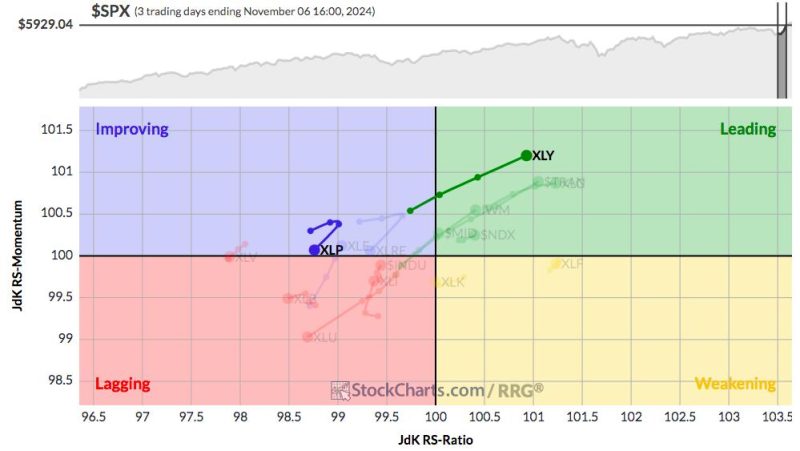

Despite the ongoing bull market, recent market dynamics have revealed a significant rotation in sector performance. Sectors that have traditionally been market leaders, such as technology and consumer discretionary, have shown signs of fatigue, while previously lagging sectors like energy and financials have started to outperform.

One of the driving forces behind this sector rotation is the shift in economic outlook and market sentiment. As the global economy recovers from the impacts of the pandemic, investors are recalibrating their expectations and adjusting their portfolios accordingly. Sectors that stand to benefit from this economic rebound, such as energy and financials, are gaining favor among investors seeking to capitalize on the recovery.

Furthermore, rising inflationary pressures and expectations of interest rate hikes have also influenced the sector rotation. Companies in sectors like energy and financials are seen as better positioned to weather inflationary headwinds, making them attractive options for investors looking to hedge against rising prices.

Additionally, the increasing focus on sustainability and environmental, social, and governance (ESG) factors is shaping investor preferences and driving capital towards sectors that align with these values. Companies committed to sustainable practices and responsible business conduct are gaining traction in the market, leading to a reevaluation of traditional sector allocations.

In light of these evolving market dynamics, investors are advised to reassess their portfolio allocations and consider diversifying across sectors that offer growth potential and resilience in the face of changing market conditions. Maintaining a balanced and diversified investment strategy can help navigate the uncertainties of the market and capitalize on emerging opportunities.

In conclusion, the secular bull market in stocks continues to thrive, albeit with a notable rotation in sector performance. Understanding the underlying factors driving this rotation and adjusting investment strategies accordingly is crucial for navigating the changing market landscape and maximizing growth potential. By staying informed, adaptable, and diversified, investors can position themselves to capitalize on the opportunities presented by the evolving market dynamics.