The week ahead in the stock market is likely to see the Nifty index trading within a range, with potential for trending moves if specific price levels are breached. To understand how the market may behave in the coming days, it is essential to analyze key technical levels and market dynamics.

## Key Support and Resistance Levels

Support and resistance levels play a crucial role in determining the market’s direction. For the Nifty index, the immediate support level is identified at 15,800, followed by a stronger support level at 15,700. If the index breaches these support levels, it could signal further downside potential.

On the upside, the Nifty faces resistance at 16,000 levels. A decisive breach above this resistance could lead to a bullish trend, with the next resistance seen at 16,200.

## Market Sentiment and Momentum

Market sentiment is a critical factor that influences trading behavior. Currently, the sentiment in the stock market remains cautious, with investors monitoring global cues, inflation data, and corporate earnings. Any unexpected developments could impact market sentiment and trigger sharp moves in either direction.

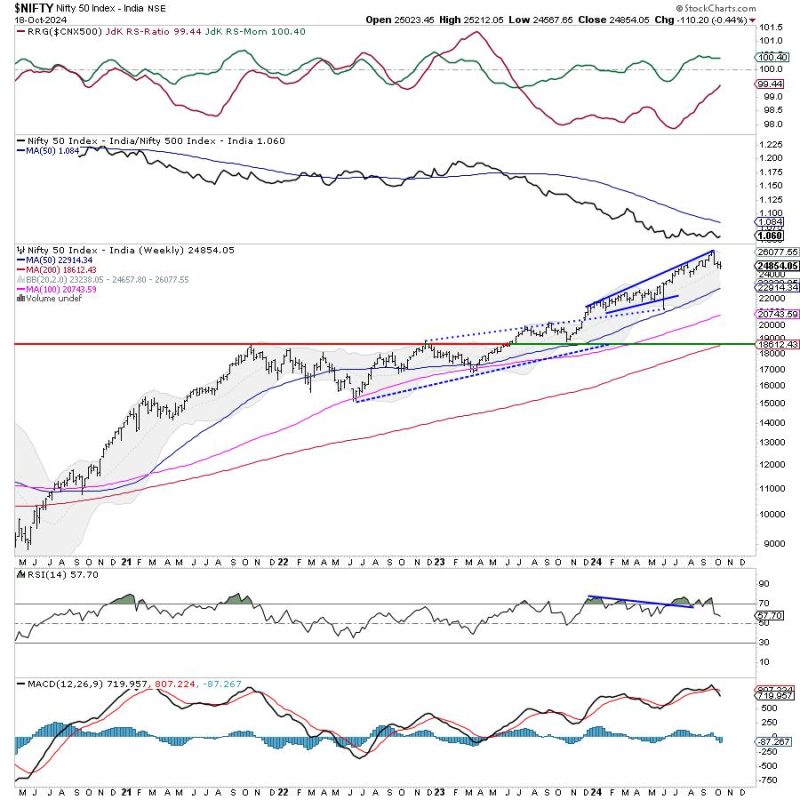

Momentum indicators such as Relative Strength Index (RSI) and Moving Averages can provide insights into the market’s strength and direction. Traders should closely monitor these indicators to gauge potential trend reversals or continuations.

## Macro-Economic Factors

Apart from technical levels and market sentiment, macro-economic factors play a significant role in shaping market movements. Key economic indicators to watch out for include GDP growth, inflation rates, interest rate decisions, and government policies. Any surprises in these factors can lead to volatility in the stock market.

Global cues, geopolitical tensions, and movements in commodities and currencies also influence the stock market. Traders should stay informed about these external factors to anticipate potential market moves.

## Risk Management and Trade Strategy

Managing risk is essential for successful trading. Traders should set stop-loss levels to protect their capital and implement a disciplined approach to trading. Diversification, proper position sizing, and a clear trade strategy are crucial for managing risks and maximizing returns.

Having a well-defined trade strategy based on technical analysis, fundamental research, and market insights can help traders navigate volatile market conditions and capitalize on opportunities.

In conclusion, the Nifty index is likely to trade within a range in the upcoming week, with the potential for trending moves if key support and resistance levels are breached. Traders should closely monitor technical levels, market sentiment, and macro-economic factors to make informed trading decisions and manage risks effectively. By adopting a disciplined approach and staying informed about market dynamics, traders can navigate the stock market with confidence and take advantage of profitable trading opportunities.