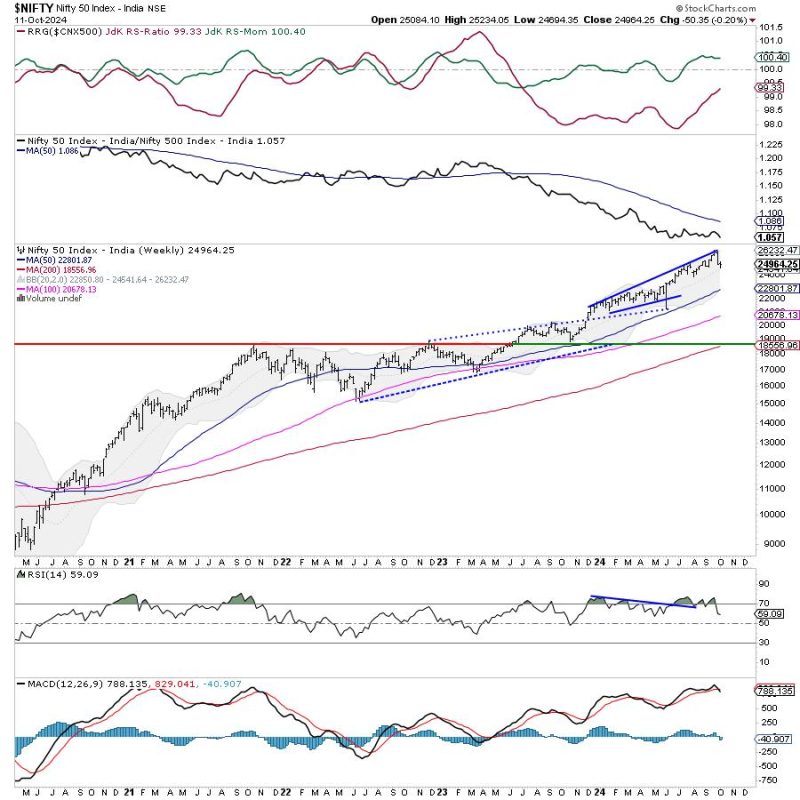

In the fast-paced world of financial markets, staying ahead of the curve is crucial for investors and traders alike. Navigating through the complexities of market volatility requires a strategic approach and a keen eye for opportunities. As the Nifty index consolidates, it is essential to keep a watchful eye on key levels that could serve as crucial indicators for potential market movements.

One of the key areas to monitor is the support and resistance levels of the Nifty index. These levels act as barriers that can influence the direction of price movements. By observing how the index behaves around these levels, traders can gain valuable insights into market sentiment and potential trends. A break above a resistance level could signal a bullish trend, while a drop below a support level could indicate a bearish market sentiment.

Furthermore, monitoring the trading volume can provide additional confirmation of market trends. An increase in trading volume during a price movement suggests strong market participation and conviction, making the trend more likely to continue. Conversely, low trading volume during a price movement raises concerns about the sustainability of the trend and may indicate a lack of conviction among market participants.

Technical indicators such as moving averages and oscillators can also offer valuable insights into market trends. Moving averages smooth out price fluctuations and provide a clear indication of the overall trend direction. Oscillators, on the other hand, help identify overbought or oversold conditions in the market, offering potential entry or exit points for traders.

In addition to technical analysis, keeping an eye on macroeconomic events and global news developments is crucial for a comprehensive understanding of market dynamics. Economic indicators, central bank decisions, geopolitical events, and other external factors can all influence market sentiment and lead to significant price movements. Being aware of these events and their potential impact on the market can help traders make more informed decisions and manage risk more effectively.

In conclusion, as the Nifty index consolidates, maintaining a vigilant stance and monitoring key levels and indicators will be crucial for navigating the market effectively. By combining technical analysis with an understanding of macroeconomic events, traders can position themselves strategically and capitalize on emerging opportunities in the market. Staying informed and adaptable in the face of market fluctuations will be essential for success in the dynamic world of financial markets.