Equities Say Go Fish: How Healthy Are the Markets?

A strong equity market is crucial to the overall health of an economy. With equities serving as indicators of the financial well-being of companies, it is essential to assess the current state of the equity markets to gauge the health of the economy. In recent times, the markets have been on a rollercoaster ride, as various factors influence their performance. Let’s explore some key elements that contribute to determining the health of the equity markets.

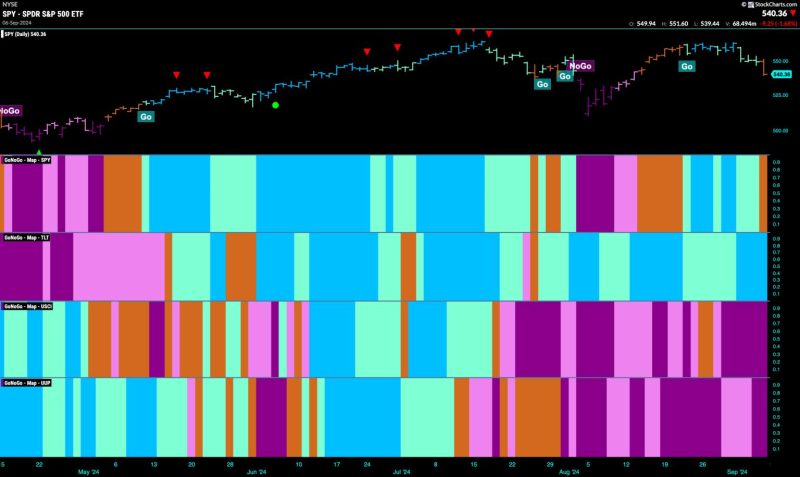

Market Volatility: Volatility is a common phenomenon in the equity markets and can impact investor sentiment. High levels of volatility can lead to uncertainty and panic selling, causing market fluctuations. Monitoring volatility indexes such as the VIX can provide insight into market stability and potential risks.

Earnings Reports: Corporate earnings play a significant role in market performance. Strong earnings indicate healthy businesses, leading to higher stock prices and investor confidence. Conversely, disappointing earnings can trigger sell-offs and market downturns. It is essential to track earnings reports to assess the financial health of companies and their impact on the equity markets.

Economic Indicators: Economic data such as GDP growth, unemployment rates, and consumer spending can influence investor behavior and market trends. Positive economic indicators are generally correlated with market uptrends, reflecting a healthy economy. Monitoring key economic indicators helps investors make informed decisions and predict market movements.

Interest Rates: The Federal Reserve’s monetary policy and interest rate decisions have a significant impact on the equity markets. Lower interest rates stimulate economic growth and stock market performance, as borrowing becomes cheaper. Conversely, rising interest rates can slow down economic activity and dampen investor enthusiasm. Observing interest rate changes and the Fed’s policy direction is crucial in assessing market health.

Geopolitical Events: Geopolitical developments such as trade tensions, political instability, and global conflicts can create uncertainties in the equity markets. These events can lead to market volatility and affect investor confidence. Keeping track of geopolitical risks and their potential impact on the economy is essential in evaluating market conditions.

Market Sentiment: Investor sentiment plays a crucial role in influencing market movements. Positive sentiment can drive stock prices higher, while negative sentiment can lead to sell-offs and market declines. Monitoring investor sentiment indicators such as the CNN Fear & Greed Index can provide insights into market trends and potential investment opportunities.

In conclusion, assessing the health of the equity markets involves analyzing various factors such as market volatility, earnings reports, economic indicators, interest rates, geopolitical events, and investor sentiment. By understanding these key elements and their impact on market performance, investors can make informed decisions and navigate the ever-changing landscape of the equity markets effectively. Stay informed, stay vigilant, and remember that the health of the markets is a reflection of the broader economy.