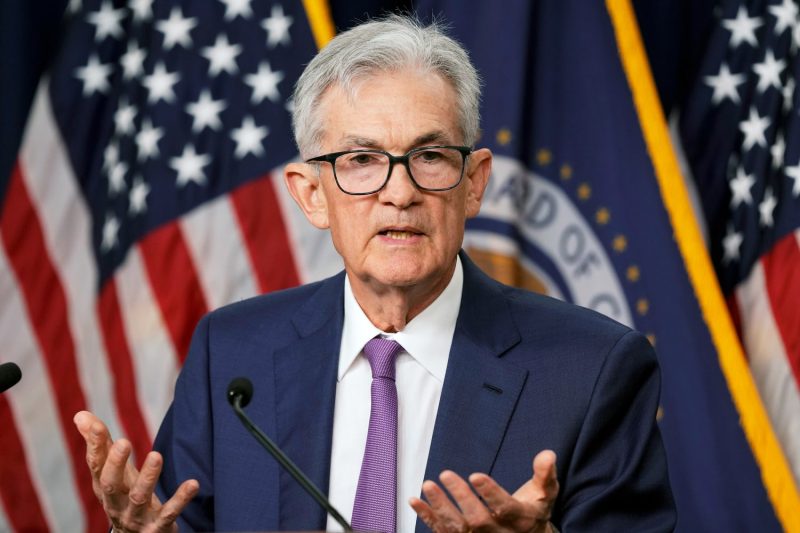

In a recent press conference, Federal Reserve Chair Jerome Powell made significant remarks regarding the current state of inflation in the United States. Powell noted that inflation has been consistently higher than previously thought and highlighted the Federal Reserve’s commitment to maintaining steady interest rates in response to this economic challenge.

Powell’s acknowledgement of escalating inflation rates reflects a growing concern within the economic landscape. The unexpected surge in prices has raised doubts about the transitory nature of inflation, which was previously posited by policymakers. This reevaluation of inflation data suggests that the economy may be facing a more prolonged period of heightened price levels, prompting the need for a comprehensive strategy to address these inflationary pressures.

The Federal Reserve’s decision to hold interest rates steady in light of rising inflation is a strategic move aimed at balancing economic growth and price stability. By keeping rates unchanged, the Fed aims to support continued economic expansion while also safeguarding against the risk of runaway inflation. This cautious approach underscores the central bank’s commitment to carefully monitoring economic indicators and making data-driven decisions to mitigate potential risks to the economy.

Powell’s remarks signal a proactive stance by the Federal Reserve in navigating the current economic challenges posed by persistent inflation. By acknowledging the reality of higher-than-expected inflation rates and maintaining a steady interest rate policy, the Fed aims to instill confidence in the markets and provide stability to the economy. This measured approach reflects a commitment to sound monetary policy and prudent economic management in the face of evolving economic conditions.

Looking ahead, the Federal Reserve’s decision to hold rates steady will likely have ripple effects across financial markets and the broader economy. Investors, businesses, and consumers will closely monitor the central bank’s actions for clues about future monetary policy moves and the Fed’s assessment of inflationary pressures. Powell’s comments serve as a critical signal to the markets about the Fed’s commitment to supporting economic growth while also addressing the challenges posed by inflation.

In conclusion, Federal Reserve Chair Jerome Powell’s remarks on inflation and interest rates highlight the central bank’s proactive stance in addressing economic challenges. By acknowledging the reality of higher-than-expected inflation and maintaining steady interest rates, the Fed aims to navigate the current economic landscape with prudence and caution. Powell’s comments underscore the importance of data-driven decision-making and strategic policy adjustments to ensure economic stability and sustainable growth in the face of evolving market conditions.