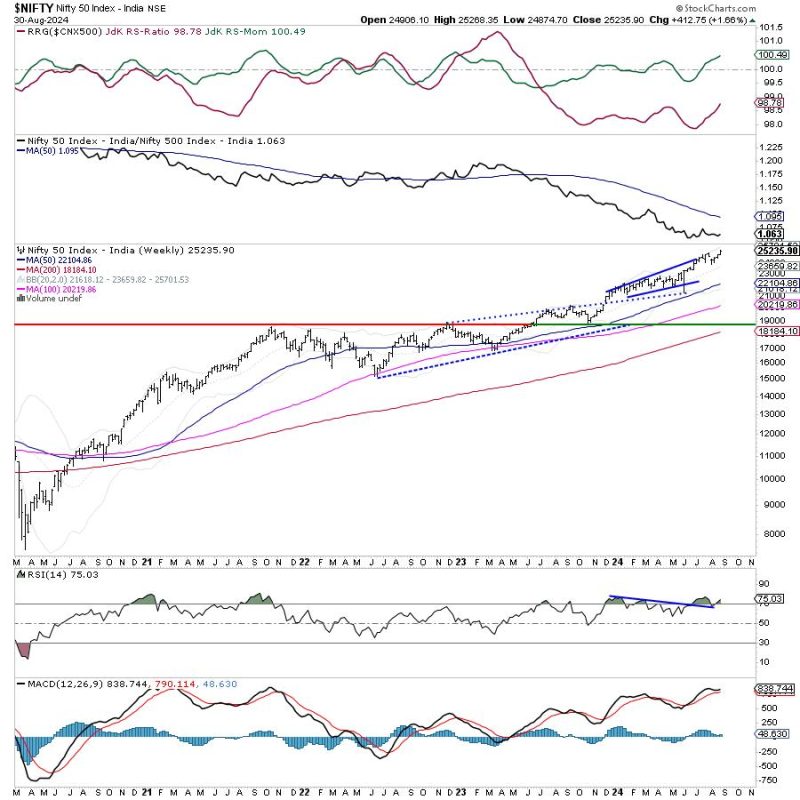

The article highlighted the uptrend in the Nifty with a distinctly defensive setup on the Relative Rotation Graph (RRG). As we delve deeper into the dynamics of these indicators, it becomes evident that the market is poised for interesting developments in the upcoming week.

Analyzing the data from the Nifty, we see a strong uptrend in place. This trend is supported by positive price action and a favorable market sentiment. Investors and traders have been riding this uptrend, benefiting from the bullish momentum in the market. However, with the RRG showing a distinctly defensive setup, it is important to be cautious and prepared for potential shifts in market dynamics.

The defensive setup on the RRG suggests that certain sectors or stocks may perform better in the current market environment. Investors should pay attention to these signals and consider adjusting their portfolios accordingly. This may involve reallocating investments to sectors that are poised to outperform in the coming weeks.

Moreover, it is crucial to stay informed about key economic events and market developments that could impact the Nifty. Factors such as geopolitical tensions, economic data releases, and corporate earnings can all influence market movements. By staying updated on these developments, investors can make informed decisions and adjust their strategies as needed.

In conclusion, while the uptrend in the Nifty remains intact, the defensive setup on the RRG signals a potential shift in market dynamics. Investors should stay vigilant, analyze market indicators, and adjust their portfolios accordingly to navigate potential changes in the market environment successfully. By employing a proactive and informed approach, investors can position themselves to capitalize on market opportunities and protect their investments in the face of uncertainty.