The Interplay Between Cryptocurrency Fraud Schemes and Traditional Financial Institutions

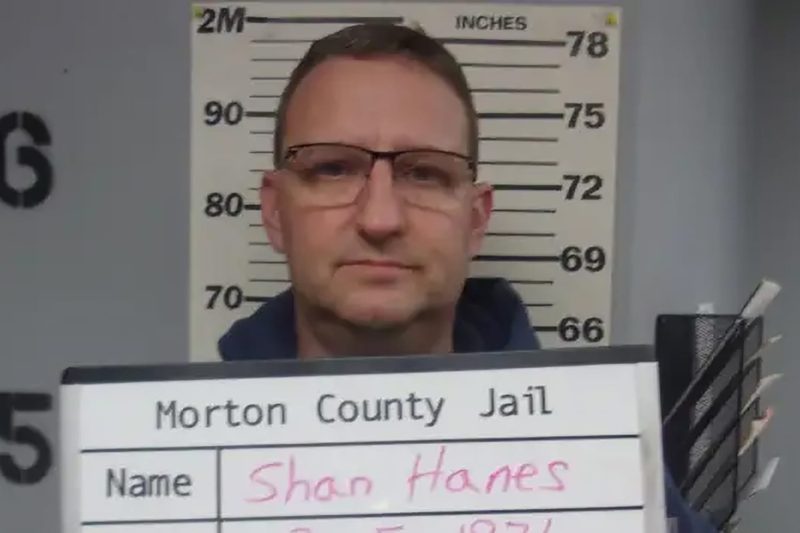

Cryptocurrencies have taken the financial world by storm, offering increased privacy, security, and decentralization compared to traditional banking systems. However, along with the benefits come unique challenges, as evidenced by the recent case of a cryptocurrency pig-butchering scam that wreaked havoc on a Kansas bank and led to the imprisonment of the ex-CEO for 24 years. This case highlights the sophisticated nature of some cryptocurrency fraud schemes and their ability to disrupt even well-established financial institutions.

The scheme involved the fraudulent sale of an initial coin offering (ICO) for a virtual currency called PigToken, which was supposedly backed by assets related to pig farming. The perpetrators lured investors with promises of high returns and the opportunity to participate in the booming cryptocurrency market. However, behind the scenes, the scheme was nothing more than a Ponzi scheme, with funds from new investors used to pay fake returns to earlier investors.

What makes this case particularly troubling is the way in which the perpetrators manipulated the traditional banking system to facilitate their scheme. The ex-CEO of the Kansas bank, who was instrumental in securing the bank’s involvement in the PigToken ICO, abused his position of trust to launder money and cover up the fraudulent activities. By leveraging the bank’s reputation and resources, the perpetrators were able to legitimize their scheme in the eyes of unsuspecting investors.

Furthermore, the use of cryptocurrencies added another layer of complexity to the scheme. Cryptocurrencies provide a level of anonymity and pseudonymity that is not possible with traditional banking transactions, making it easier for fraudsters to cover their tracks and evade detection. In this case, the perpetrators used a complex web of wallet addresses and mixing services to obfuscate the flow of funds, making it difficult for law enforcement to trace the money and hold the responsible parties accountable.

The fallout from the cryptocurrency pig-butchering scam has had far-reaching consequences, not only for the investors who lost their savings but also for the bank and its customers. The bank’s reputation has been severely tarnished, leading to a loss of trust and a decline in business. The ex-CEO’s imprisonment serves as a cautionary tale for others in positions of power who may be tempted to abuse their authority for personal gain.

In conclusion, the case of the cryptocurrency pig-butchering scam highlights the need for greater vigilance and regulation in the cryptocurrency space. While cryptocurrencies offer many advantages, they also present unique risks that must be addressed to protect investors and maintain the integrity of the financial system. By learning from past mistakes and implementing robust security measures, we can better safeguard against future fraud schemes and ensure the long-term viability of cryptocurrencies as a legitimate asset class.