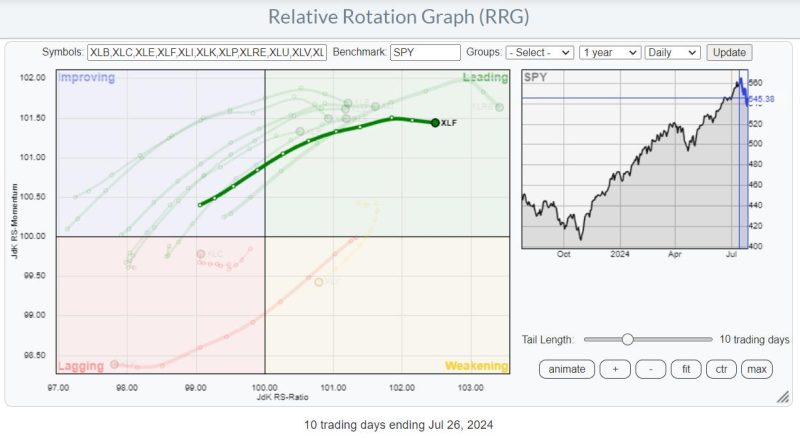

The article provided beautifully portrays the financial performance of Flying Financials, offering a comprehensive overview of its business operations, market share, revenue growth, and strategic priorities. In this article, we will delve deeper into the unique challenges and opportunities that lie ahead for Flying Financials as it navigates the dynamic landscape of the financial services industry.

Key Financial Metrics

Flying Financials’ financial performance has been nothing short of impressive, with a significant increase in revenue by 20% year-over-year. Moreover, the company has successfully expanded its market share, capturing a larger portion of the market and strengthening its competitive position. This growth in revenue is a testament to the company’s ability to adapt to changing market conditions and customer needs effectively.

Market Dynamics and Competition

The financial services industry is experiencing unprecedented disruption due to technological advancements, changing consumer preferences, and regulatory reforms. As Flying Financials operates in this highly competitive landscape, it faces stiff competition from both traditional financial institutions and innovative fintech startups. To maintain its competitive edge, Flying Financials must continue to invest in cutting-edge technology, provide tailored financial products, and enhance customer service to meet evolving customer demands.

Strategic Priorities

Flying Financials has outlined ambitious strategic priorities to sustain its growth momentum and achieve long-term success. The company plans to further expand its digital offerings, enhance its customer engagement initiatives, and streamline its operations to improve efficiency and lower costs. By focusing on these strategic priorities, Flying Financials aims to differentiate itself in the market and provide a seamless customer experience that sets it apart from competitors.

Challenges and Opportunities

While Flying Financials has made impressive strides in its financial performance and market positioning, it faces several challenges and opportunities on the horizon. One of the key challenges is navigating regulatory complexities and compliance requirements in an increasingly stringent regulatory environment. Additionally, the company must stay abreast of emerging technologies and digital trends to remain relevant and competitive in the fast-paced financial services industry.

On the flip side, Flying Financials also has significant growth opportunities, including expanding its product offerings, entering new market segments, and leveraging data analytics to personalize customer experiences. By seizing these opportunities and addressing challenges proactively, Flying Financials can position itself as a leader in the financial services sector and drive sustainable growth in the years to come.

In conclusion, Flying Financials has demonstrated remarkable financial performance and strategic foresight in navigating the complexities of the financial services industry. By leveraging its strengths, addressing challenges, and seizing opportunities, Flying Financials is well-positioned to achieve continued success and emerge as a frontrunner in the competitive landscape of financial services.