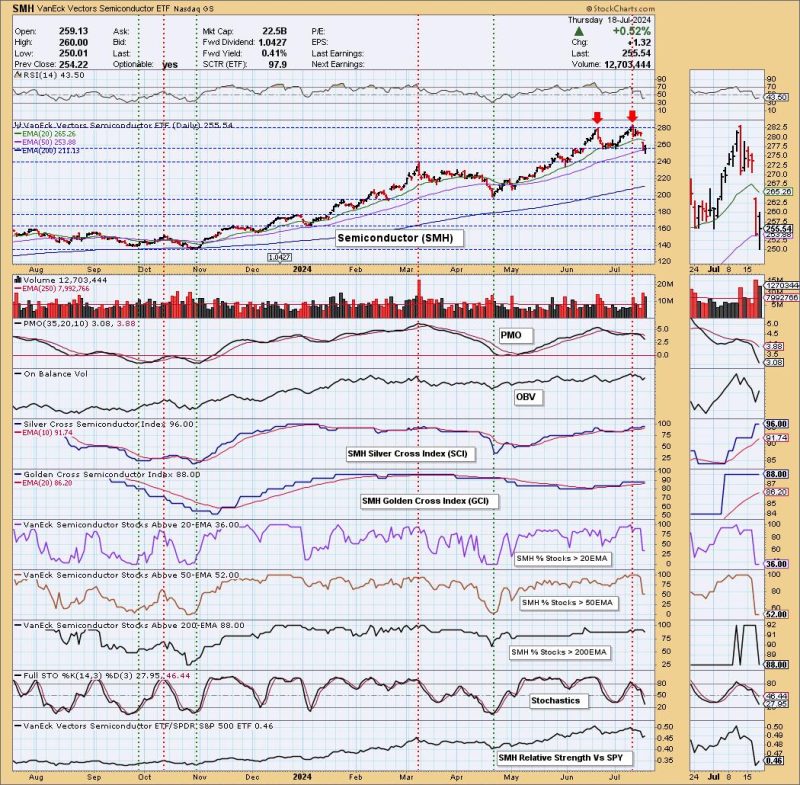

The semiconductor industry has long been at the forefront of technological advancement, driving innovation across various sectors from consumer electronics to healthcare and automotive. As one of the key pillars of the modern economy, developments in the semiconductor market are closely watched by investors and analysts alike. In recent weeks, the semiconductor sector has caught the attention of traders due to the formation of a double top pattern on the SMH ETF, an exchange-traded fund that tracks the performance of semiconductor companies.

The double top pattern is a bearish technical signal that typically indicates a potential reversal in the current uptrend. This pattern forms when an asset reaches a high price level, retraces, then makes a second attempt at that high, only to fail and reverse lower. In the case of the SMH ETF, the double top pattern has raised concerns among some market participants about the potential for a pullback in semiconductor stocks.

The semiconductor sector has been a standout performer in recent years, driven by strong demand for chips across a wide range of applications. The shift towards remote work and increased online activities during the Covid-19 pandemic further boosted demand for semiconductor products, leading to robust performance in semiconductor stocks. However, concerns about supply chain disruptions, geopolitical tensions, and potential slowing growth in key markets have weighed on the sector in recent months.

Technical analysts often use chart patterns like the double top as a tool to identify potential turning points in the market. The formation of a double top on the SMH ETF suggests that the previous highs may represent a significant resistance level that could cap further upside in the near term. Traders watching this pattern closely are looking for confirmation of a bearish reversal, which would be signaled by a breakdown below the neckline of the pattern.

While technical analysis can provide valuable insights into market dynamics, it is important to consider other factors that may influence the semiconductor sector’s performance. Industry trends, macroeconomic conditions, regulatory developments, and company-specific news can all impact semiconductor stocks independently of technical patterns. Investors in the semiconductor sector should therefore take a holistic approach to their analysis, incorporating both technical and fundamental factors into their decision-making process.

In conclusion, the formation of a double top pattern on the SMH ETF highlights the potential for a bearish reversal in the semiconductor sector. While this technical signal warrants attention from traders and investors, it is only one piece of the puzzle in understanding the complex dynamics of the semiconductor market. By taking a comprehensive approach to analysis and staying informed about industry trends, market participants can make well-informed decisions in navigating the fast-paced world of semiconductor investments.