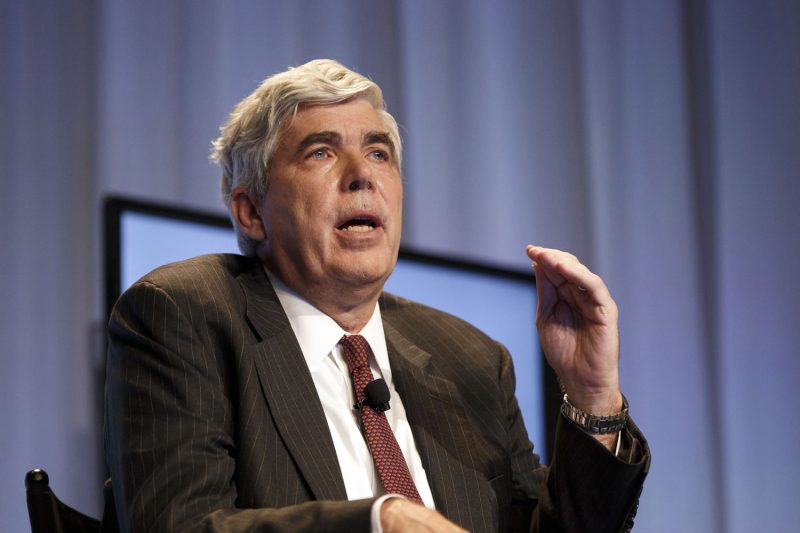

In a recent development that has sent shockwaves through the financial world, the United States has pressed charges against former Wamco executive Kenneth Leech for alleged fraudulent activities. This legal action comes after an extensive investigation into Leech’s financial dealings during his time at Wamco, a prominent company in the financial services sector.

The charges against Leech include accusations of manipulating financial records, misrepresenting the company’s financial situation, and engaging in fraudulent activities to deceive investors and stakeholders. These grave allegations have brought to light the importance of accountability and transparency in the financial industry, as well as the severe consequences that can result from fraudulent behavior.

The case against Kenneth Leech serves as a cautionary tale for executives and professionals in the financial sector, highlighting the legal and ethical responsibilities that come with managing financial resources and information. The charges he faces not only threaten his professional reputation but also underscore the potential legal repercussions of engaging in fraudulent activities.

This high-profile case also raises important questions about corporate governance and oversight within financial institutions. It underscores the need for robust internal controls, independent audits, and whistleblowing mechanisms to prevent and detect fraudulent activities. By holding individuals like Kenneth Leech accountable for their actions, the authorities seek to send a clear message that fraudulent behavior will not be tolerated in the financial industry.

As the legal proceedings against Kenneth Leech unfold, the financial world will be closely watching the outcome of this case. It serves as a reminder of the importance of honesty, integrity, and ethical behavior in all financial dealings, and the severe consequences that can result from betraying the trust of investors and stakeholders.

In conclusion, the charges pressed against Kenneth Leech serve as a stark reminder of the need for ethical conduct and transparency in the financial industry. While the legal process will determine his guilt or innocence, this case highlights the importance of upholding high ethical standards and maintaining the trust of investors and stakeholders in the financial sector.