The upcoming week in the Nifty index is likely to witness sluggish movement with multiple resistances posing challenges for any significant upward momentum. Key technical levels and market data will play a crucial role in determining the direction of the index. Let’s delve deeper into the factors that are anticipated to influence the market in the upcoming week.

Technical Analysis:

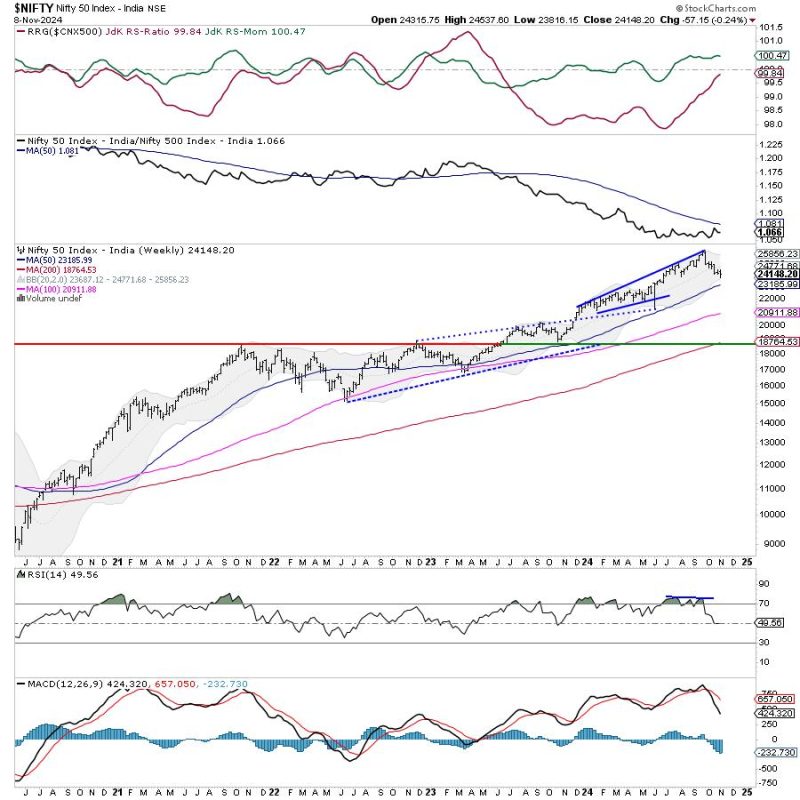

The Nifty index is currently facing strong resistance near the 15,900 levels. This zone has proven to be a formidable barrier for the index to breach in recent trading sessions. Moreover, indicators such as the Relative Strength Index (RSI) and Moving Averages suggest that the index is currently overbought, signaling a potential pullback or consolidation phase.

On the downside, immediate support is seen near the 15,600 levels. If the index fails to sustain above this crucial level, we may witness a downside movement towards the next support at 15,400. Therefore, traders are advised to closely monitor these support and resistance levels to gauge the market sentiment accurately.

Market Sentiment and Economic Data:

Several factors are likely to influence the market sentiment in the upcoming week, including the progress of the monsoon, global cues, and corporate earnings. Any developments on the COVID-19 front, such as vaccine efficacy data or new variants, could also impact market sentiment and trading patterns.

Investors will closely watch economic data releases such as GDP numbers, inflation data, and industrial output for insights into the country’s economic health. Additionally, global factors such as geopolitical tensions, central bank policies, and movement in commodity prices will also influence market movements.

Trading Strategy:

Given the current technical outlook and market sentiment, traders are advised to adopt a cautious approach and look for short-term trading opportunities. It is crucial to set stop-loss levels and adhere to risk management practices to mitigate potential losses in case of adverse market movements.

Moreover, investors should closely monitor news flow, company-specific developments, and macroeconomic indicators to make informed trading decisions. Diversification of portfolio and allocation of funds across different sectors can help in managing risk and optimizing returns in a volatile market environment.

In conclusion, the Nifty index is likely to face hurdles in the upcoming week, with multiple resistances limiting any significant upside potential. Traders should closely monitor technical levels, market sentiment, and economic data to navigate through the market uncertainties and identify profitable trading opportunities. Staying informed, disciplined, and adaptable will be key to succeeding in the dynamic market environment.