The article Short-Term Bearish Signal as Markets Brace for News-Heavy Week offers insights into the current market conditions and the potential impact of upcoming events on investor sentiment. As the financial markets gear up for a busy week of news and economic indicators, traders are preemptively bracing for potential bearish signals in the short term.

The article highlights key factors contributing to the cautious outlook among investors. Firstly, the anticipation of major news events, such as economic data releases, corporate earnings reports, and geopolitical developments, has created a sense of uncertainty in the market. This uncertainty has been compounded by lingering concerns about inflation, interest rates, and global economic recovery post-pandemic.

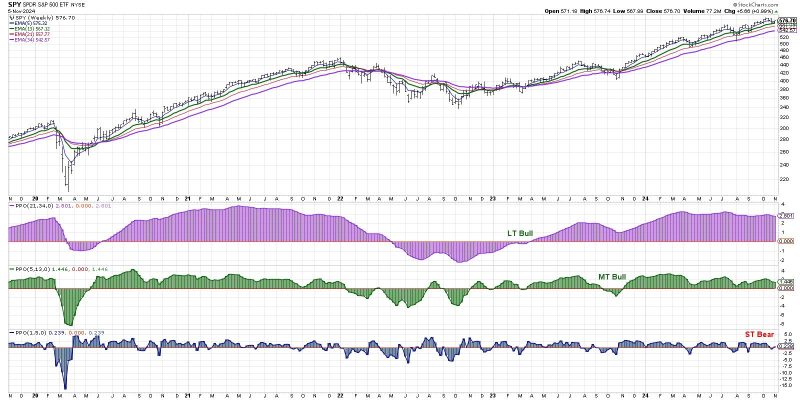

Another significant consideration mentioned in the article is the technical analysis that suggests a short-term bearish trend may be on the horizon. The article points to indicators such as moving averages, relative strength index (RSI), and support levels, which are signaling a potential shift towards bearish sentiment in the near future.

Moreover, the article emphasizes the importance of risk management strategies for traders navigating such volatile market conditions. It advises investors to remain vigilant, stay abreast of market developments, and consider implementing defensive measures to protect their portfolios against potential downside risks.

In conclusion, the article paints a cautious picture of the current market environment and underscores the need for investors to exercise prudence and diligence in their decision-making processes. By staying informed, monitoring key market indicators, and being prepared for potential downside risks, traders can position themselves more effectively in the face of a news-heavy week that may bring about short-term bearish signals.