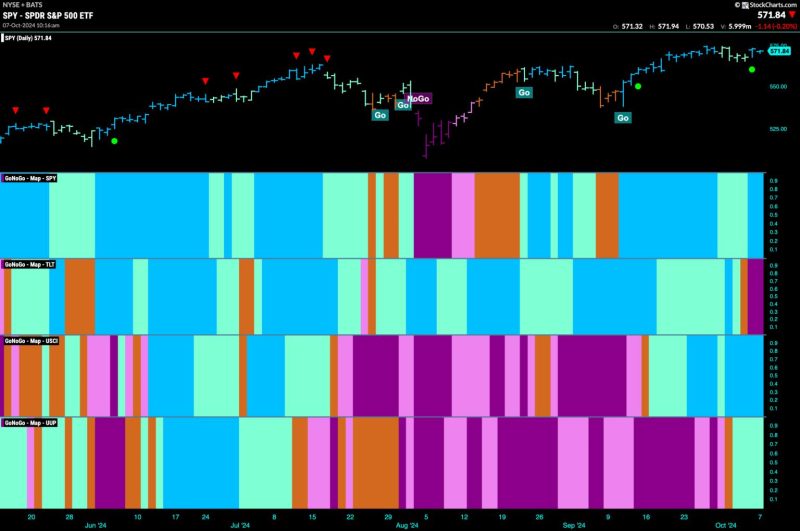

Equities Remain in Go Trend and Lean Into Energy

Equities have continued to show strength and resilience in recent months, with investors remaining in a go trend despite ongoing uncertainties. The global equities market has been on an upward trajectory, driven by strong corporate earnings, improving economic data, and positive sentiment. While there have been intermittent bouts of volatility, the overall bullish trend has prevailed, attracting more investors to the market.

One sector that has been particularly appealing to investors in this environment is the energy sector. Energy stocks have been on the rise, buoyed by the rebound in oil prices and increasing demand for energy worldwide. Companies operating in the energy sector, such as oil and gas producers, renewable energy firms, and utilities, have all benefited from the general uptrend in equities, outperforming other sectors in recent months.

Investors are also leaning into energy stocks due to their perceived value and potential for growth. Energy companies, many of which were undervalued during the pandemic-induced market downturn, are now seen as attractive investment opportunities, offering the potential for significant returns as the global economy recovers and energy demand rebounds. Additionally, the transition towards renewable energy sources and sustainable practices has further fueled interest in energy stocks, as investors seek to capitalize on the shift towards a greener economy.

Another factor driving the bullish sentiment in equities is the accommodative monetary policy stance of central banks around the world. With interest rates at historically low levels and central banks committing to providing ample liquidity, investors have been encouraged to take on more risk and allocate capital to equities. The easy monetary policy environment has supported asset prices and contributed to the positive momentum in equities, leading investors to remain optimistic about the market outlook.

However, despite the prevailing bullish trend, investors should remain cautious and vigilant in navigating the equity market. The potential for market volatility remains, especially in light of uncertainties surrounding global economic growth, inflation, and geopolitical tensions. It is essential for investors to diversify their portfolios, conduct thorough research, and seek professional advice to mitigate risks and make informed investment decisions.

In conclusion, equities continue to exhibit strength and resilience, with investors remaining in a go trend and leaning into energy stocks. The positive momentum in the global equities market, supported by strong corporate earnings, improving economic data, and accommodative monetary policy, has driven investors to pursue opportunities in the energy sector. While there are inherent risks and uncertainties in the market, diligent research, diversification, and prudent decision-making can help investors navigate the evolving landscape and capture potential returns in the equity market.