In the world of finance and investing, it is crucial to maintain a broad perspective when analyzing market movements. One key indicator to watch in this regard is the Nifty index, which serves as a benchmark for the Indian stock market. By closely monitoring the Nifty index and analyzing its movements from various angles, investors can gain valuable insights into the overall market trends and make informed decisions.

One essential aspect to consider when examining the Nifty index is its historical performance. Looking at past data can provide valuable information about how the index has fared in different market conditions and how it has reacted to various events. By studying historical trends and patterns, investors can develop a better understanding of the Nifty index’s behavior and use this knowledge to anticipate future movements.

Another important perspective to consider is the macroeconomic environment. Factors such as interest rates, inflation, economic growth, and geopolitical events can have a significant impact on the stock market and the Nifty index. By staying informed about the broader economic landscape and how it might influence the Nifty index, investors can better position themselves to navigate potential risks and opportunities.

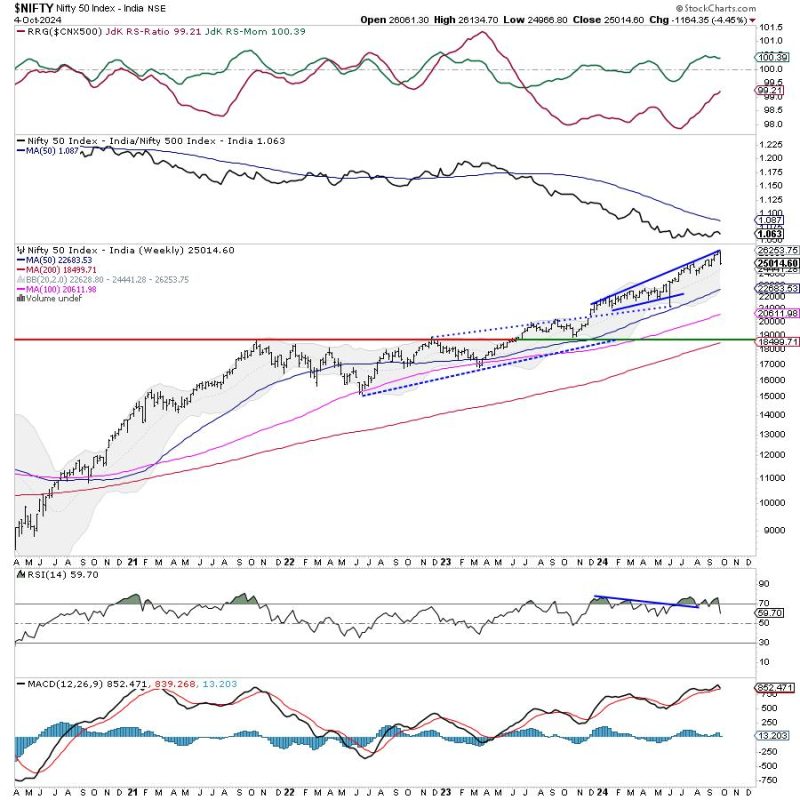

Technical analysis is another valuable tool for gaining insights into market movements, including those of the Nifty index. By studying charts, trends, and key technical indicators, investors can identify potential entry and exit points and make more informed trading decisions. Technical analysis can provide a different angle from which to view market movements and complement fundamental analysis in shaping a comprehensive investment strategy.

Furthermore, keeping an eye on market sentiment and investor behavior can offer valuable insights into the Nifty index’s movements. Sentiment indicators, such as fear and greed indexes, can help gauge market participants’ emotions and tendencies, providing clues about potential market turning points. By understanding investor sentiment and behavior, investors can better anticipate market moves and take advantage of opportunities that arise.

In conclusion, analyzing the Nifty index from multiple perspectives, including historical performance, macroeconomic factors, technical analysis, and market sentiment, can provide investors with a comprehensive view of market movements. By integrating these various angles into their investment approach, investors can make more informed decisions and navigate the complexities of the stock market with greater confidence.