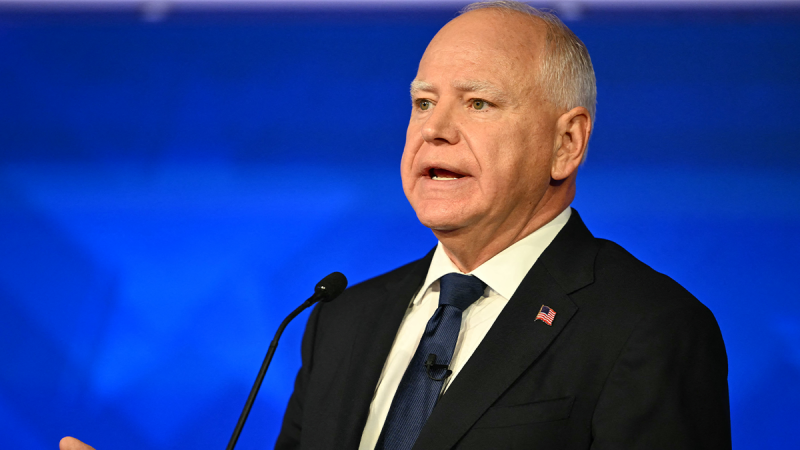

In a recent turn of events, Governor Tim Walz faced significant backlash after defending an Obama-era mandate that was repealed by former President Trump, leading to massive tax penalties for Minnesotans. The controversy stems from Walz’s stance on the individual mandate within the Affordable Care Act (ACA), commonly known as Obamacare.

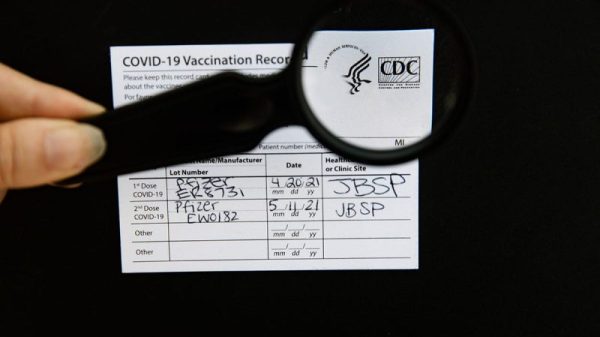

The individual mandate, a key provision of the ACA, required all Americans to have health insurance coverage or face a tax penalty. However, in 2017, President Trump and the Republican-led Congress repealed this provision through the Tax Cuts and Jobs Act. This decision was met with both support and criticism, with opponents arguing that it infringed on individual freedoms while proponents believed it was necessary for supporting the ACA’s insurance markets.

Governor Walz’s defense of the individual mandate has sparked controversy among residents of Minnesota, who now face significant tax penalties for non-compliance. While some believe that the mandate was a necessary measure to ensure widespread healthcare coverage and lower costs, others argue that it unfairly penalizes individuals who choose not to purchase insurance.

The backlash against Walz centers on his failure to address the concerns of those who are now struggling with these tax penalties. Critics argue that his continued support for the individual mandate disregards the financial burden it places on many Minnesotans, particularly those who may not be able to afford health insurance or choose not to purchase it for personal reasons.

Moreover, the debate over the individual mandate raises broader questions about the role of government in healthcare and individual autonomy. Supporters of the mandate argue that it is essential for maintaining a balanced insurance market and ensuring access to healthcare for all, while opponents view it as government overreach that infringes on personal freedom.

As Governor Walz grapples with the fallout from his defense of the individual mandate, it remains to be seen how he will address the concerns of Minnesota residents facing substantial tax penalties. The controversy highlights the complexities of healthcare policy and the challenges of balancing the needs of individuals with the broader goals of public health and access to care.