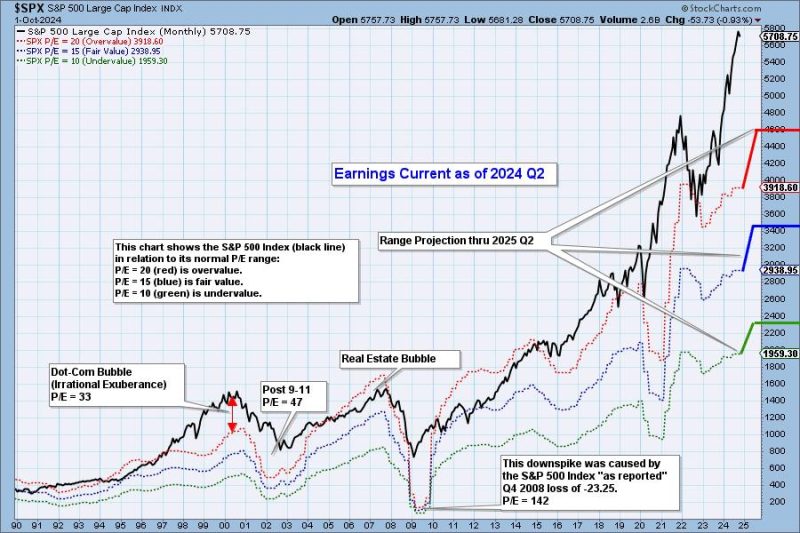

With 2024 Q2 Earnings In, Market Remains Very Overvalued

The global market continues to present an air of uncertainty as companies release their Q2 earnings reports for 2024. The latest data reveals a widespread trend of overvaluation that is causing concern among investors and analysts alike. Despite a solid performance in some sectors, overall market conditions remain precarious, with numerous factors contributing to the continued state of overvaluation.

One significant driver of the overvaluation issue is the unequal recovery following the economic downturn caused by the global pandemic. While certain industries, such as technology and e-commerce, have experienced rapid growth and strong earnings, others, particularly those in the travel and hospitality sectors, continue to struggle. This disparity in performance has led to an uneven distribution of market valuations, with some sectors trading at significant premiums compared to historical averages.

Furthermore, the market remains vulnerable to external shocks, such as geopolitical tensions, regulatory changes, and unexpected economic events. These factors add further uncertainty to an already precarious situation, exacerbating concerns about the sustainability of current market valuations. As a result, investors are becoming increasingly cautious, opting for a more defensive investment approach to mitigate risks associated with potential market corrections.

In addition to sector-specific challenges, rising inflation poses a significant threat to market stability. The escalation of inflationary pressures has already had a tangible impact on consumer spending and corporate profit margins, prompting concerns about the broader economic implications. Higher inflation could erode companies’ profitability and purchasing power, leading to a downward revision of earnings expectations and potentially triggering a market correction.

Another key factor contributing to the market’s overvaluation is the influx of liquidity resulting from accommodative monetary policies. Central banks worldwide have maintained low interest rates and engaged in quantitative easing programs to support economic recovery, flooding the market with cheap capital. While these measures have been effective in boosting asset prices and stimulating economic activity, they have also fueled speculative behavior and contributed to inflated market valuations.

Looking ahead, the path to market normalization remains uncertain, with numerous challenges and risks on the horizon. Investors and analysts are closely monitoring developments in key economic indicators, corporate earnings reports, and policy changes to gauge the market’s resilience and potential vulnerabilities. In the face of heightened uncertainty, it is essential for investors to adopt a cautious and diversified investment strategy to weather potential market volatility and safeguard their portfolios against downside risks.

In conclusion, the 2024 Q2 earnings season has shed light on the ongoing issue of market overvaluation, highlighting the fragility of current market conditions and the need for prudent risk management. As investors navigate a complex and uncertain investment landscape, maintaining a disciplined and informed approach is crucial to mitigating potential losses and capitalizing on opportunities in a volatile market environment.