The article provided offers insightful analysis on the Nifty index, showcasing early indications of a potential disruption in the uptrend and advising investors to exercise caution moving forward. This analysis is crucial for stakeholders in the financial markets as it helps anticipate potential market shifts and adjust investment strategies accordingly.

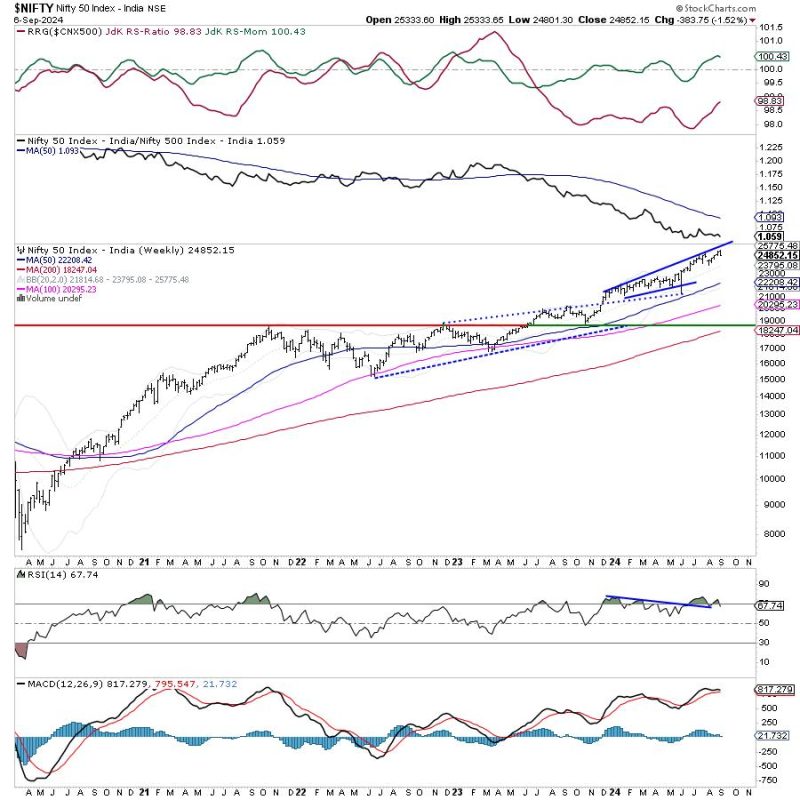

The article first highlights the technical developments in the Nifty index, pointing out specific levels and trends that suggest a possible deviation from the prevailing uptrend. This technical analysis provides readers with tangible data to base their decisions on, adding a layer of objectivity to the assessment of market conditions.

Moreover, the article goes on to emphasize the significance of the Nifty surpassing critical resistance levels in order to maintain its upward trajectory. The emphasis on resistance levels underscores the importance of closely monitoring market movements and responding promptly to shifts that could impact investment outcomes.

In addition to the technical analysis, the article touches upon the broader market sentiment and external factors that could influence the Nifty’s performance. By including these macroeconomic considerations, the analysis becomes more comprehensive and gives readers a holistic view of the forces at play in the financial markets.

Furthermore, the article’s cautionary tone serves as a valuable reminder to investors about the unpredictability of the markets and the need to exercise prudence in decision-making. This message of prudence can help investors avoid impulsive actions and base their choices on thorough analysis and informed judgment.

Overall, the article provides a well-rounded assessment of the Nifty index’s current position, offering readers valuable insights to guide their investment strategies. By combining technical analysis, market sentiment evaluation, and a cautionary approach, the article equips stakeholders with the necessary tools to navigate the complexities of the financial markets successfully.