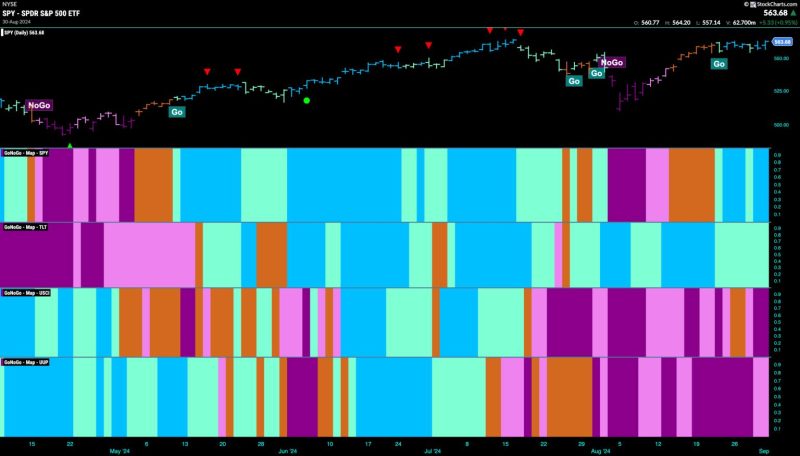

Equities Hold Firm in Go Trend as Industrials Play Strong Defense

Amidst the ever-evolving landscape of the global economy, equities have shown remarkable resilience in the face of uncertainty, with industrials emerging as stalwarts of strength in these volatile times. As investors navigate through the complexities of market dynamics, the Go trend in equities has captured the spotlight, providing a beacon of hope and stability in the midst of changing tides.

One of the key factors behind the strong performance of equities lies in the robust defense displayed by the industrials sector. Industrials, encompassing a wide range of companies involved in manufacturing, construction, engineering, and more, have proven to be reliable assets in times of market turbulence. Their ability to weather the storm and remain steadfast in the face of challenges has solidified their position as a strong defensive play for investors seeking stability and consistent returns.

The industrial sector’s resilience can be attributed to several factors. Firstly, the essential nature of many industrial companies’ products and services ensures steady demand even during economic downturns. From machinery and equipment to transportation and infrastructure, industrial goods are the backbone of many sectors, creating a reliable revenue stream that mitigates market fluctuations.

Additionally, industrials have demonstrated adaptability and innovation in response to changing market conditions. Companies within this sector have embraced technology, automation, and sustainable practices to enhance efficiency, reduce costs, and drive growth. This forward-thinking approach has enabled industrials to not only survive but thrive in challenging environments, positioning them as attractive investment opportunities for discerning investors.

Furthermore, the global interconnectedness of the industrial sector provides diversification benefits for investors. By operating across various regions and serving diverse markets, industrial companies are less susceptible to localized risks and can leverage growth opportunities on a global scale. This geographic diversification enhances the sector’s resilience and shields it from the impact of regional economic downturns or geopolitical tensions.

The Go trend in equities, characterized by a bullish sentiment and a focus on growth-oriented investments, has further propelled industrials into the spotlight. As investors seek opportunities that offer strong growth potential and a buffer against market volatility, the industrials sector has emerged as a favored destination for capital allocation. The sector’s combination of stability, growth prospects, and defensive qualities aligns well with the objectives of investors looking to navigate uncertain market conditions with confidence.

In conclusion, equities have demonstrated remarkable strength in the prevailing Go trend, with industrials playing a pivotal role in anchoring the market and providing a solid defense against uncertainties. The sector’s resilience, adaptability, and global reach have positioned it as a standout performer in today’s dynamic economic landscape. As investors continue to seek opportunities that offer stability and growth potential, industrials stand out as a compelling choice for those looking to navigate the complexities of the market with resilience and assurance.