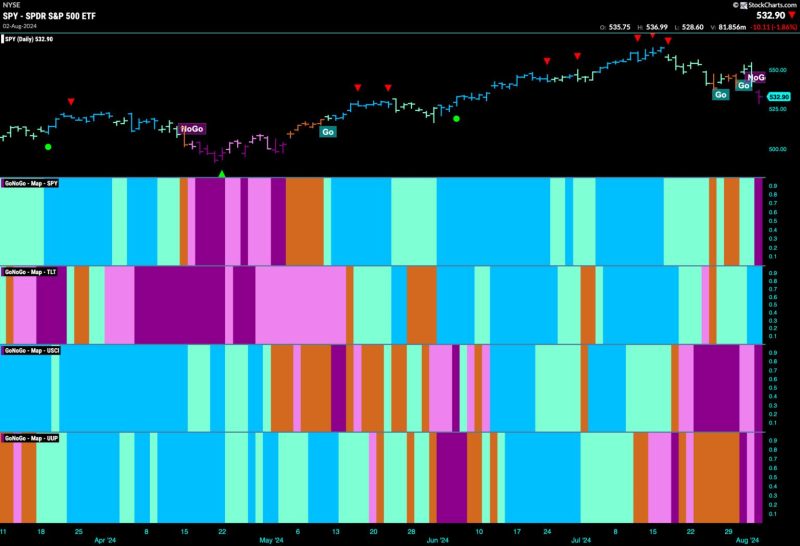

Stocks Get Defensive as Market Index Enters ‘NoGo’ Zone

The recent volatility in the stock market has prompted investors to adopt a defensive stance as the market index enters the ‘NoGo’ zone. This shift in strategy reflects the uncertainties and challenges currently facing the global economy. In times of uncertainty, investors tend to flock towards defensive stocks, which are known for their stability and resilience during turbulent market conditions.

Defensive stocks typically belong to sectors that are less sensitive to economic cycles, such as utilities, healthcare, and consumer staples. These companies provide essential goods and services that are in demand regardless of economic conditions, making their stocks less susceptible to sharp declines in value during market downturns. As a result, defensive stocks are often seen as a safe haven for investors looking to protect their portfolios during times of market turbulence.

In contrast, cyclical stocks, which are more closely tied to the overall health of the economy, tend to experience more significant fluctuations in price during market corrections. Sectors such as technology, industrials, and financials are examples of cyclical industries that can be particularly vulnerable during economic downturns. For this reason, investors are increasingly turning to defensive stocks as a way to mitigate risk and preserve capital in uncertain market environments.

The current shift towards defensive stocks is also driven by concerns about rising inflation and interest rates. Inflationary pressures can erode the purchasing power of consumer incomes and corporate profits, leading to lower overall economic growth. As central banks respond to inflation by raising interest rates, investors may become more cautious about investing in riskier assets such as growth stocks and high-flying tech companies.

Given these economic headwinds, defensive stocks are likely to remain in favor among investors seeking to protect their portfolios from market volatility. Companies that provide essential goods and services, have strong cash flows, and stable earnings are well-positioned to weather the storm and deliver consistent returns to investors. As the market index enters the ‘NoGo’ zone, it is crucial for investors to reassess their investment strategies and consider the role of defensive stocks in their portfolios.

In conclusion, the current market environment calls for a defensive approach to investing as the market index enters a period of heightened uncertainty. Defensive stocks offer stability and resilience in the face of economic challenges, making them an attractive option for investors looking to protect their portfolios from market volatility. By allocating a portion of their portfolios to defensive stocks, investors can mitigate risk and preserve capital during turbulent market conditions.