The article begins by delving into the importance of breadth indicators in the financial world, particularly in relation to the stock market. The author highlights how these indicators provide valuable insights into the overall health and direction of the market, beyond just looking at individual stock performances. The article then focuses on one specific breadth indicator – the Percentage of Stocks Above Their 200 Day Moving Average (PCT200) – and its implications.

The PCT200 indicator serves as a measure of market breadth, showing the percentage of stocks that are trading above their 200-day moving average. When a large portion of stocks are above this key moving average, it suggests a healthy market with widespread participation and upward momentum. Conversely, a lower percentage indicates weakness and potential downside risk in the market.

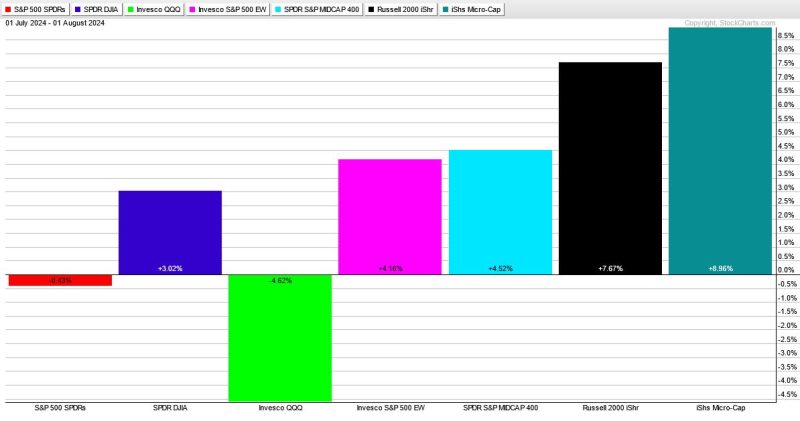

The article goes on to highlight that the PCT200 indicator currently shows a significant divergence between the indicator and the S&P 500 index. This divergence suggests that while the index has been reaching new highs, a smaller percentage of individual stocks are actually participating in this rally. This discrepancy raises concerns about the sustainability of the market’s upward trend and could be a warning sign of a potential correction or downside risk.

Despite the cautionary tone of the article, it also presents a silver lining. The author suggests that periods of divergence between the PCT200 indicator and the S&P 500 could present unique opportunities for investors. By recognizing and interpreting these signals early on, investors can prepare themselves for potential market shifts and adjust their strategies accordingly.

In conclusion, the article emphasizes the importance of monitoring breadth indicators like the PCT200 in addition to traditional stock analysis. These indicators can provide valuable insights and early warnings about potential market movements, helping investors make informed decisions and capitalize on opportunities even in times of uncertainty.