Pre-earnings Moves Are Underway, Let’s Decode History to Identify Them

Investing in the stock market involves a balance of risk and reward. One key aspect that many investors focus on is predicting pre-earnings moves, which can provide valuable insights into a company’s financial health and potential stock price movements. By analyzing historical data and trends, investors can gain a better understanding of how a stock may behave leading up to an earnings announcement.

Historical Data as a Predictive Tool

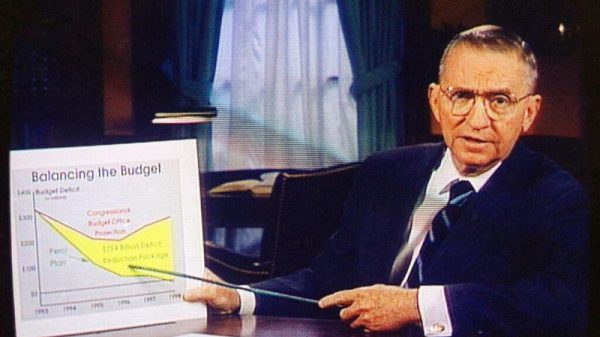

Historical data serves as a valuable tool for investors looking to anticipate pre-earnings moves. By examining past earnings reports and stock price behavior, investors can identify patterns and trends that may provide clues about how a company is likely to perform in the future. For instance, if a company consistently beats earnings estimates, the stock price may rally leading up to the next earnings announcement.

One common strategy used by investors is to analyze the price action of a stock in the days or weeks leading up to an earnings release. By studying how a stock has historically behaved before earnings, investors can make more informed decisions about buying, selling, or holding their positions. This historical analysis can help investors identify potential patterns and trends that may indicate a stock is likely to move in a certain direction before an earnings announcement.

Volatility and Price Swings

Volatility is a key factor to consider when predicting pre-earnings moves. Stocks that experience high levels of volatility leading up to an earnings announcement are more likely to see significant price swings. This can present both opportunities and risks for investors. While high volatility can lead to larger profits if a stock moves in the desired direction, it also increases the potential for substantial losses if the stock moves against expectations.

Investors often look at options pricing to gauge market expectations about a stock’s potential price movements around an earnings announcement. Options with higher implied volatility tend to be more expensive, as they reflect the increased uncertainty and potential for significant price swings. By analyzing options pricing, investors can gain insights into market sentiment and expectations leading up to an earnings release.

Managing Risks and Maximizing Returns

Predicting pre-earnings moves is a challenging task that requires careful analysis and risk management. While historical data and trends can provide valuable insights, it’s important for investors to remember that past performance is not indicative of future results. Market conditions and company-specific factors can change rapidly, leading to unexpected outcomes.

To manage risks and maximize returns when predicting pre-earnings moves, investors should consider diversifying their portfolios and using risk management tools such as stop-loss orders. Additionally, investors should stay informed about macroeconomic trends, company news, and industry developments that may impact a stock’s price leading up to an earnings announcement.

In conclusion, historical data and trends can be valuable tools for predicting pre-earnings moves in the stock market. By analyzing past performance, volatility levels, and options pricing, investors can gain insights into how a stock may behave before an earnings announcement. However, it’s important to exercise caution and employ proper risk management strategies to navigate the uncertainties of the stock market effectively.