In the world of investing, there are various strategies available that traders and investors can utilize to maximize their profits and manage risks effectively. One such approach is trend following, which involves analyzing price movements to identify and follow market trends. In this article, we will delve into the concept of trend following and how it can be put into practice to achieve successful money management.

Understanding Trend Following

Trend following is a popular trading strategy based on the premise that financial markets tend to move in trends or patterns over time. By identifying and following these trends, traders aim to capitalize on the momentum in the market and ride the trend to generate profits. This strategy is grounded in the notion that trends are more likely to continue than to reverse abruptly, allowing traders to position themselves accordingly to benefit from sustained price movements.

Putting Trend Following into Practice

To implement trend following effectively, traders need to adopt a systematic approach that is rule-based and objective. This involves setting clear and predefined rules for entering and exiting trades based on specific criteria related to price movements and market conditions. By following these rules consistently, traders can mitigate emotional decision-making and maintain discipline in their trading activities.

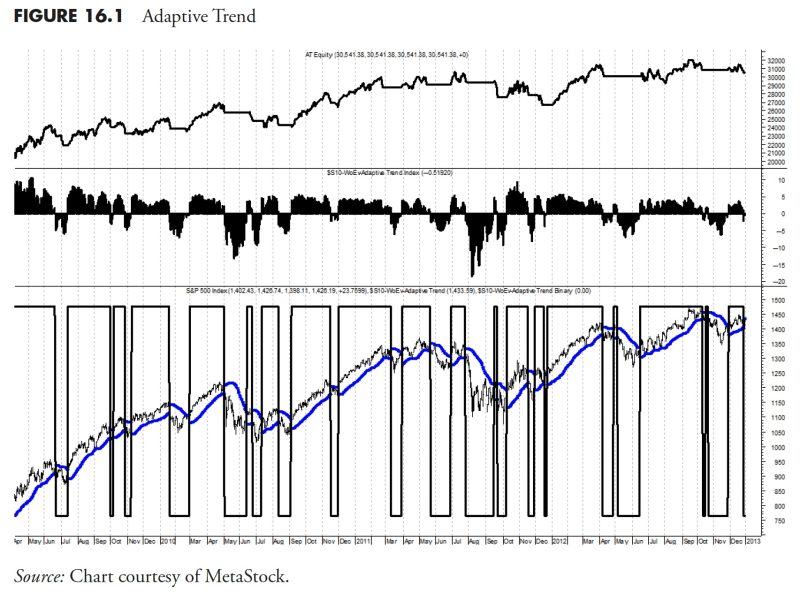

One key aspect of trend following is the use of technical indicators and tools to identify potential trends and confirm market direction. Moving averages, trendlines, and momentum oscillators are commonly used to gauge the strength and direction of a trend, helping traders make informed decisions about when to enter or exit a position. Risk management is also crucial in trend following, as it involves setting stop-loss orders and position sizing based on predefined risk parameters to protect capital and minimize losses.

By incorporating trend following into their money management strategy, traders can benefit from its ability to capture significant price movements and participate in trending markets effectively. This approach allows traders to adapt to changing market conditions and adjust their strategies accordingly to capitalize on emerging trends and opportunities.

In conclusion, trend following is a powerful trading strategy that can be a valuable tool for investors looking to enhance their money management practices. By employing a systematic and rule-based approach, traders can effectively navigate the complexities of the financial markets and harness the power of trends to achieve their investment goals. With proper implementation and risk management, trend following can help traders identify profitable opportunities and optimize their trading performance in both bull and bear markets.