The Hindenburg Omen: Understanding Its Significance in Market Analysis

The Hindenburg Omen is a sophisticated technical analysis tool used by traders to identify potential market downturns. It is based on a series of market indicators that, when triggered together, suggest a heightened risk of a market crash. The name Hindenburg Omen was coined in reference to the famous Hindenburg disaster of 1937, drawing a parallel between the sudden and catastrophic event and a potential market crash.

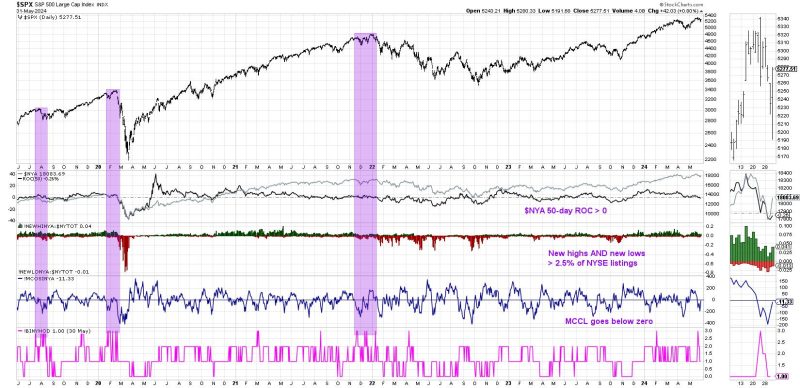

One of the key components of the Hindenburg Omen is market breadth. Market breadth refers to the number of individual stocks participating in a market rally or decline. When a large number of stocks are making new highs or lows simultaneously, it indicates a lack of market consensus and potential trouble ahead. The Omen is triggered when a set of specific criteria related to market breadth are met within a relatively short time frame.

It’s important to note that while the Hindenburg Omen has been associated with market downturns in the past, it is not a foolproof indicator of an impending crash. Like any technical analysis tool, the Omen should be used in conjunction with other forms of analysis and risk management strategies.

Traders and investors should approach the Hindenburg Omen with caution and use it as one of many tools in their arsenal. Relying solely on the Omen to make investment decisions could lead to missed opportunities or unnecessary panic. It is essential to consider the broader market context, economic indicators, geopolitical events, and other factors that can influence market movements.

Furthermore, it’s crucial to remember that markets are inherently unpredictable, and no single indicator can accurately predict future outcomes with certainty. The Hindenburg Omen, while an interesting concept in technical analysis, should be viewed as part of a comprehensive approach to risk management and decision-making.

In conclusion, the Hindenburg Omen is a valuable tool for traders and investors to monitor market breadth and potential risks. By understanding its significance and limitations, market participants can make more informed decisions and better navigate the complexities of financial markets.