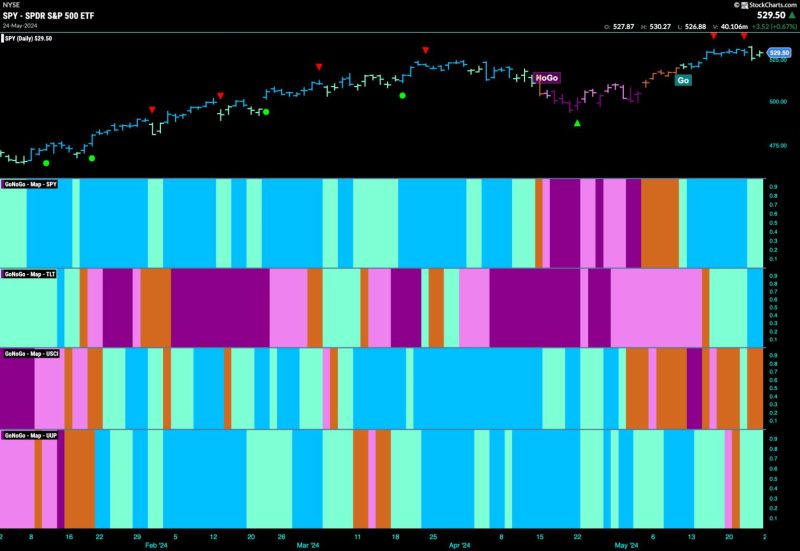

Equities Continue in Go Trend with Sparse Leadership from Tech and Utilities

The equity market has shown resilience and continues to exhibit an upward trend, with sporadic leadership coming from the technology and utilities sectors. This trend indicates the underlying strength of the market amidst various challenges being faced globally.

One of the noteworthy aspects of the current market scenario is the limited leadership being provided by the technology sector. Tech companies have traditionally been at the forefront of driving market performance, but recent fluctuations have led to a more subdued role for this industry. While some tech giants continue to perform well, others have faced challenges such as regulatory scrutiny and supply chain disruptions. This mixed performance has resulted in a more dispersed leadership dynamic within the sector, impacting overall market trends.

On the other hand, the utilities sector has emerged as an unexpected source of leadership in the equity market. Typically known for its stability and consistent returns, the utilities sector has been quietly outperforming other industries. This trend can be attributed to factors such as increasing demand for clean energy solutions and growing interest in sustainable investing. As investors seek opportunities that align with environmental and social considerations, utilities companies offering renewable energy sources have seen increased demand and market value.

While tech and utilities play a significant role in shaping market trends, other sectors have also contributed to the overall positive performance of equities. Industries such as healthcare, consumer goods, and industrials have shown solid performance, further diversifying the sources of market leadership. This broad-based strength indicates a healthy level of optimism among investors and reflects a balanced outlook for the equity market.

Despite the uncertainties and challenges faced by the global economy, equities have remained resilient and are currently moving in a positive direction. The dynamic leadership from sectors like technology and utilities, coupled with the consistent performance of other industries, underscores the underlying strength of the equity market. Investors are closely monitoring these trends and adjusting their strategies to capitalize on emerging opportunities.

In conclusion, the equity market continues to exhibit a go trend with sporadic leadership from key sectors like technology and utilities. While the performance of these sectors influences market trends, the overall strength and resilience of equities suggest a positive outlook for investors. By staying informed and agile in response to changing market dynamics, investors can navigate uncertainties and capitalize on the diverse opportunities offered by various industries.